By Elizabeth S. Craig, @elizabethscraig

I had my tax appointment with my accountant on February 2nd. This is really not “my thing,” but I feel a lot better now that I’ve got a CPA helping me. Although, as I walked into her office on the 2nd, I said, “You know, taxes really make me anxious” and I promptly dropped all my receipts and papers on the floor. Apparently in an attempt to show, not tell.

But after all the trouble and the figure-finding and the paper shuffling, I found that I actually had some pretty interesting data. Here’s what I found out about tax year 2014:

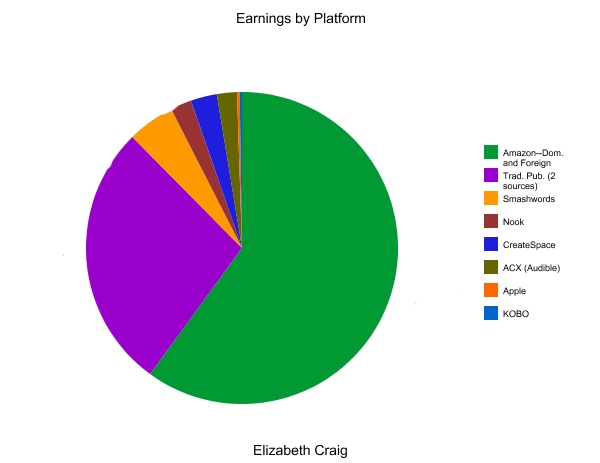

Breakdown of earnings

So the above chart just sort of shows earnings by publisher/retailer.

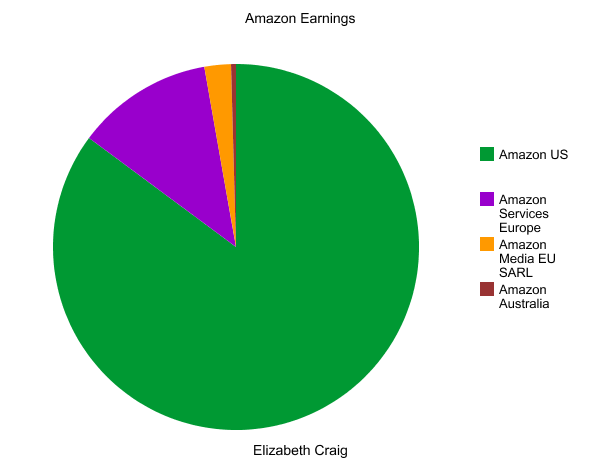

The chart above shows earnings by different Amazon regions.

Notes:

Earnings from my traditionally-published titles (2 sources/publishers) reflect 9 published books.

Self-pub earnings (everything else) reflect 6 published books.

The Apple percentage is artificially low because it reflects 1 book (I used Smashwords to distribute the others)

The Kobo percentage is artificially low because it reflects 1 book (again, I used Smashwords to distribute the other titles)

Takeaways:

The first thing I noticed was how low the Nook profits were. I mean…barely much over the CreateSpace or the ACX (audiobooks). Wow.

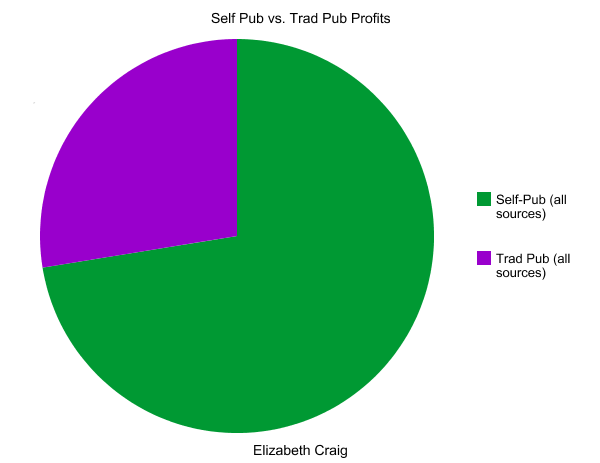

You’d think that a takeaway of mine should be that the trad published books brought in a lot less despite the higher number of titles. But this doesn’t come as a shock to me. :) Still, it’s pretty amazing seeing it on the graph. Here it is shown a different way:

It felt as if I didn’t make as much last year. I even told my accountant at the beginning of our appointment that I didn’t make as much last year. She told me I was wrong…I made a bit more in 2014 than in 2013. 7.1% more. Why didn’t it feel that way? I think the earnings still slowed…I had 3 more titles published in 2014. So it seems as though the earnings should have been higher.

Also, I think the fact that I put 50% of my earnings away for taxes (which really made me unhappy) made me feel as if I just didn’t have as much income. As self-employed people in the US, we’re employer and employee. Although putting that money away was a smart move.

What I did right last year (tax-wise)

As I’ve mentioned before, 2014 was the first year that I had a dedicated separate account for income and expenses related to my writing career. My accountant strongly urged me to create this account since the Internal Revenue Service here in the States doesn’t like seeing business income and household expenses mixed together. This worked really well. I was able to get a sense of my actual earnings a lot easier by reviewing the year’s deposits…even before the slew of 1099 forms arrived in my mailbox.

I put 50% aside for taxes.

I paid estimated quarterly taxes. This also helped avoid that huge tax bill I got in 2013.

What I think I’ll change for 2015 (tax-wise)

I need to divide my earnings up by publisher/retailer before seeing my accountant next year. I originally just turned in some lump figure of income. I’d also like to track my income quarterly to get a better picture of what I’m looking at as I’m going through the year.

I handed all my book production costs this year to my accountant as “production costs.” But in 2013, we’d divided them into editor fees, cover design, formatting, etc. I think I need to keep those divided up next year.

I need to remember that I need to get the 1099s for Smashwords, Apple, and Kobo downloaded off those sites. I’d forgotten that was a download.

I need to make my appointment with my accountant next year in mid-February. I got a flurry of 1099s in the mail earlier this week and I had to keep updating her.

So, that’s what I came up with. Did you make any interesting observations regarding your sales or earnings last year? Do taxes stress you out like they do me?

Interesting which direction all the sales went.

Taxes don’t stress me out because I’m pretty good at keeping records and I just hand it all to our accountant.

Alex–I think I *keep* the records pretty well. But I think where I go wildly wrong is that I haven’t been categorizing them all along (the contracted help/covers/formatting, where the income is coming from….Amazon/publishers/Smashwords). I’m going to try to keep up with it a bit better in the hopes I don’t spend quite as much time doing this stuff next year.

My husband is dropping off yet another form to our accountant today. I thought I had them all, but they just keep coming in.

I’m very detailed when it comes to the breakdown of expenses. Carry-over from my 2 & 1/2 years of accounting in high school.

Diane–I know…they just don’t stop coming in! I thought they all had a deadline to send tax forms out by. I can imagine your being super-on top of the tax stuff.

Wow. Great job!

I know it’s horrible putting the income away. Helps when the company doles out for operating expenses, though. It isn’t as good as paying for pot roasts and school clothes; but, those purchases the business does make come with pre-tax dollars.

I have hired a family member on occasion and then there is all the equipment required for them from the ops account. My filing clerk is taking advantage of our generous tuition reimbursement program, now. She owes two years of contract labor for each school year.

I get organizational help in this way. She’ll end up being the executor of the estate if she keeps it up.

How do you find the best help? You grow them. Talk to your accountant, Elizabeth LLC.

Jack–Ha! Now *that’s* smart thinking.

I have a family member who will be taking part of a tuition reimbursement program this fall. :) I may have to take him off of trash-collection duty and into something a bit more clerical. Good thinking! And the 13 year old helps with my photography. :)

Here’s my takeaway: I’m going to take a page from Chip and Dan Heath’s book Switch and focus on the bright spots. Do more of what works and drop what doesn’t.

Henceforth, I’m not bothering with anything but what Amazon sells: Kindle and CreateSpace. My team spends as much time preparing the Smashwords versions, getting into their premium catalog, as we do creating the Kindle versions. Same effort, tiny percentage of the return. Pareto Principle to the rescue: do the 20% of the work that creates 80% of the results.

Writing is art. I’ll do any unreasonable thing necessary to create art.

Selling is business. Business needs a profit or it’s just a hobby. Profit is about relentlessly focusing on what works, and not wasting time on what doesn’t.

Joel–I can totally see your mindset on that. Lots of data to back you up.

In my case, this tiny percentage does actually equal a fair amount of income, so I’m keeping it up in the meantime.

First, thanks for this great post, Elizabeth.

:o)

I think the term accountants use for the list of expense categories you track is your “chart of accounts.” It would really help me to see the charts of accounts from several authors who have worked things out with their bookkeepers or accountants, from experience.

I get Jack’s point, a good one. Yours in reply, as well.

I think the question for any author is, individually and practically, how best to use their time at the margins. In other words, if you find you can put 2 more hours per week into your author-led business, where do you put them… realizing that X 52 weeks, that’s 104 hours in a year or 2-1/2 forty-hour weeks. So, significant.

Maybe your individual nature and circumstance would let you produce a novella with that amount of time and you could put it up on Amazon (80/20) as Joel advocates (more or less). But maybe you can’t write another word, but you can handle the administrative detail of posting your manuscript and its ebook cover and book description to Nook.

These are individual choices but are best made consciously as we (all of us) learn to drill down on the right question(s).

And right questions are found on both the artistic and the business sides of the work we do.

:o)

Thanks, again.

Ryan–I’m tracking: advertising (review copies, bookmarks, business cards), legal and professional services/contract labor (my agent’s commission, website design, formatting, cover design), postage, internet fees, professional magazines (Writer’s Digest), website hosting fees, Hootsuite Pro, Feedly Pro, domain costs, proof copies from CreateSpace, mileage for writing-related drives, conference fees, event costs (food, lodging), office expenses of printer ink/toner, copy paper, notebooks, pens, pencils, staples, etc. And then there’s the home office stuff that the accountant does the calculation for (total square footage of the home and the part used for business). There may be odds and ends, but I think this is the bulk of what I keep up with.

And your question is a good one. If I weren’t doing business-related stuff, what *would* I be doing? I probably wouldn’t be writing more. I’d likely be working on my platform, responding to emails…or even cleaning my house or cooking supper.

This may change as my older child goes off to school this fall and I have a bit more time. I think you’re right…this is up to the individual author and what suits may change over time.

Thanks, Elizabeth, for your chart of accounts (list)! Useful to see. I hope for others, too.

I’m going through the process now for the first time (in a long time) and I’ve spent so little so far that my list would be not very interesting. My business officially started (again) in 2014 (centered around http://www.EnterprisingWriter.com) and I’m in process of setting up its first set of ledgers from receipts and statements maintained. (Bad to put this off – do not do as I do.)

One thing to notice in your chart of accounts (any chart of accounts): You can collapse or expand categories (within certain limits). In your case, you can make one category out of subscriptions and conference expenses (lump them all into professional education) if you want, or not. The tax man won’t care either way.

But you may care.

Why? Because the information, if separately charted, is revelatory about your business and may enable you to see some things you want to manage. Maybe you love going to conferences but the expenses are hard to justify–once they are examined. So those expenses get separated out in your chart of accounts.

:o)

Ryan–I like your perspective. So basically, separating everything out is doing me the benefit of more data. Where are my business-related expenses going?

Elizabeth – Thanks for sharing your experience. I think it’s really important to keep records that are as detailed as possible. It’s hard to remember to do that when life gets hectic, but I’ve found that just keeping everything in a set of files helps me lay my hands on what I need to put everything together for tax time.

Margot–Files work for me, too! And I think I’m going to do a bit more paper-free stuff this year, too. May help me to put my hands on docs easier when I can tag them.

Thanks for the detailed information. I hope to publish Book 1 of a mainstream trilogy this year, so I’m just starting (and may never earn more than a few dollars – we’ll see).

I’ve figured out I do not need a separate business account yet – I can get by for several books/years before needing that, and there is a time and money cost .

I also plan to stick to Amazon at the beginning – I have little energy and don’t feel like paying people to do things I can easily do myself, so expansion to other markets will have to wait, except that I do have a Mac, and iBooks may be easier for me than for most, so I MAY consider taking things out of Kindle after the three-month trial.

I’m assuming you keep good records of business expenses, and that makes it worth the accountant and all the paperwork – if I don’t have many expenses, it almost isn’t worth keeping track of them (another reason to DIY).

But I hope for success in the future – the kind of success you’re having – and paperwork is the cost of success.

I also like the idea of home-growing your assistants – I have my eye on someone. There, though, family ties probably make it more valuable – non-family members can walk away more easily, costing you money – and taking with them your training and expertise. Something to think about before hiring.

Alicia

Alicia–Hope it helps! And congratulations on the upcoming release.

Right, I don’t think you have to jump the gun on the separate account, accountant, et al right off the bat. For me, that day crept up on me. A year of great profits a couple of years back when I just enjoyed the profits and put aside, sadly, not *nearly* enough money for taxes and we ended up having to pay a ton of money (in 2013). So I’d just say…if you start doing really, really well, slow down for a moment and think about what you might need to do, from a banking standpoint. Because, in my case, my brain was going on all cylinders thinking about how to *capitalize* on the profit and not so much of “hey…this means the IRS might want some of this.” I was just slow on the uptake and paid the price with a tremendous tax bill.

Now that I’ve got expenses coming out of the business account, I do a much better job tracking it all. I did a *good* job before, but I could have done better. And the accountant helps me figure the home office type costs of internet, phone, etc.

And a good point about hiring. I did research as best I could to find my accountant (Angie’s List was a resource, if you’re familiar with the service). Needs to be someone we can trust and who is a real pro, I think.

Thanks! As I said, I have taken all this into the brain – I have some experience with accountings and taxes, and the need to set aside money for taxes, but it is always better to be looking for when you need to initiate higher levels of recordkeeping and paying the piper, than to be hit with it in arrears.

In advance hurts, but in arrears hurts a lot more.

The IRS forgive some of it, for one year, under strict conditions – but after that, you’d better change the problem areas. Or have extra money to pay penalties.

Alicia–It sounds like you’ll handle this *easily* with your accounting background. I’ll admit it’s been a struggle for me but I’ve worked hard on it. I did my own taxes for years, but when everything starting exploding during 2012, I simply wasn’t paying attention. It’s something, you’re so right, that needs to be proactively handled. It’s not an April issue. It’s a quarterly, estimated tax issue.

The CPA got me on track last year. The estimated taxes helped. The tax appointments twice a year helped, too.

“In arrears hurts a lot more.” Words of wisdom, for sure!

Hi Elizabeth,

Really good tips for those of us just starting out.

Is there a particular software program you use to log your expenses?

Thanks.

Susanne

Susanne–Nothing very fancy. For me, being able to put my hands on the stuff and categorizing it is the big deal. Currently I’m using One Note (which is included in Microsoft Office), but I’ve also used the free version of Evernote in the past. I create a “tax” notebook, with sections for “production costs” (now I’ll have pages in that section for editing, formatting, cover design), conferences (with pages for mileage, food, program fees), etc.

Thanks Elizabeth. I’ll check them out.

Thanks for all the sharing you do.

This is fascinating. Especially the trad vs. indie income. Thanks so much for sharing this!

Anne–Thanks for coming by!

Thanks for sharing Elizabeth. This was an eye-opener.

Sharla Rae–Thanks for visiting. :)

It’s great to see more writers sharing their income numbers, tax experiences, and all the new things they learn each year. I provide similar information each quarter to my blog readers and it always gets a good reception.

I track my books, what sales are made, and how much $$ I get on a rather extensive spreadsheet I keep in google docs. Color coordination is mandatory. You’re welcome to browse the sheet: https://docs.google.com/spreadsheets/d/1idJAnpbdWXrAJCLns0VKEA4AVjUIChVC7kB2Q9M1dUQ/edit?usp=sharing

I’m not making much yet, but I’m earning more each year, and that’s what counts. Thank god my mother’s a CPA (and she and my dad have owned their own business) and has walked me through Schedule C taxes for several years, so I can confidently tackle Turbo Tax by myself in about 3 or 4 hours.

I don’t have any pie charts. I really like your breakdown of trad/indie and where your indie $$ is coming from. I think I’ll do the same. But I have a few other streams of income (editing being a major one) that I’d like to compare on the same charts, so a few more numbers for me to track.

I haven’t broken out a new banking account for business just yet, but my paypal account is strictly for business, and that’s worked well so far. I haven’t needed to dive into quarterly filing … yet. I imagine I’ll see a need for that this year or next…

Thanks for sharing your details!

Tami–I like your spreadsheet. That’s a handy way of keeping track of it all. I did try to do a spreadsheet, but I kept tinkering with it (not liking the way it was formatted, etc.) and finally I fired myself from spreadsheet duty. :)

It seems to me you’re doing really well and the fact that it’s building is always a good sign. You are very fortunate to be related to a CPA and small business owners! I felt as if I were navigating very unfamiliar waters when I was trying to figure all this stuff out. If someone had *only* told me, “Hey, Elizabeth. Put *50%* aside, not *30%*,” things would have gone a lot smoother, lol.

If you like the pie charts, they are courtesy of this free site: http://nces.ed.gov/nceskids/createagraph/default.aspx . It appears to be a site for schoolkids. :) This gave me confidence that I could create a pie chart, ha.

Yes! Knowing to put 50% away makes a huge difference! I’ll be following this advice this year to avoid tax-season sticker shock.

This spreadsheet is the 5th version of such a thing. I’m a numbers nerd, but it took me years to figure out a layout that worked for me.

Tami–I think it’s a great version! I bet it helps you really keep track of the figures.

Thanks for sharing. This is very encouraging as a new self publisher. I’ve run my own business for many years and have just put my second kid on the payrol. They clean the office and this year my oldest started the bookkeeping. Wow, what a load off. I’ve started a file for writing and I’ll have him do the tracking for that as well. We use Quickbooks which is quite expensive, but there are a number of cheaper programs (they tend to get more expensive as you add payrol features) that can use the data you enter to create excellent reports categorizing income and expenses…very useful in analyzing what’s working and what’s not.

It’s also very beneficial to have a good understanding of what you can write off against your income. No sense in paying extra tax if we don’t need to.

Silas–I am thinking I’ve been very shortsighted to place my 18 year old and 13 year old on trash and cat litter duty. :)

And you’re so right about what to write off. This is huge. My accountant reminded me that the gasoline going to and from the post office (mailing review copies) and to and from the bank (depositing income that isn’t direct deposited) should be written off, as well. It’s the little things that add up.

Elizabeth,

I want to mention a useful book for the “manually inclined.” An oldy but goody that’s been kept up to date:

Small Time Operator: How to Start Your Own Business, Keep Your Books, Pay Your Taxes, and Stay Out of Trouble

Available everywhere including virtually every public library. With some ledger paper (6-column should be enough) and the reading of applicable pages, you can avoid the expense of purchasing cloud-access to a software accounting program and the like. Combined with some free online resources (the Google docs example in comment thread above), there are some good and easy ways to get started.

Thanks, again!

Ryan–I like that title…ha! Thanks. Sounds very useful. I’ll put in a request for it at the library.

Hi Elizabeth,

Very timely post. Thank you! I am to have my taxes to my acct. by the end of the week. Every year I dread pulling it all together. But after reading this post, I look forward to getting some info from the stats. Love the charts!

Susan Gabriel

author of The Secret Sense of Wildflower

(southern, historical, coming-of-age)

A best book of 2012–Kirkus Reviews

Susan–Oh gosh, I dread it too. But then, there *is* interesting data at the end of it all. Thanks for coming by!